Operating margin meaning

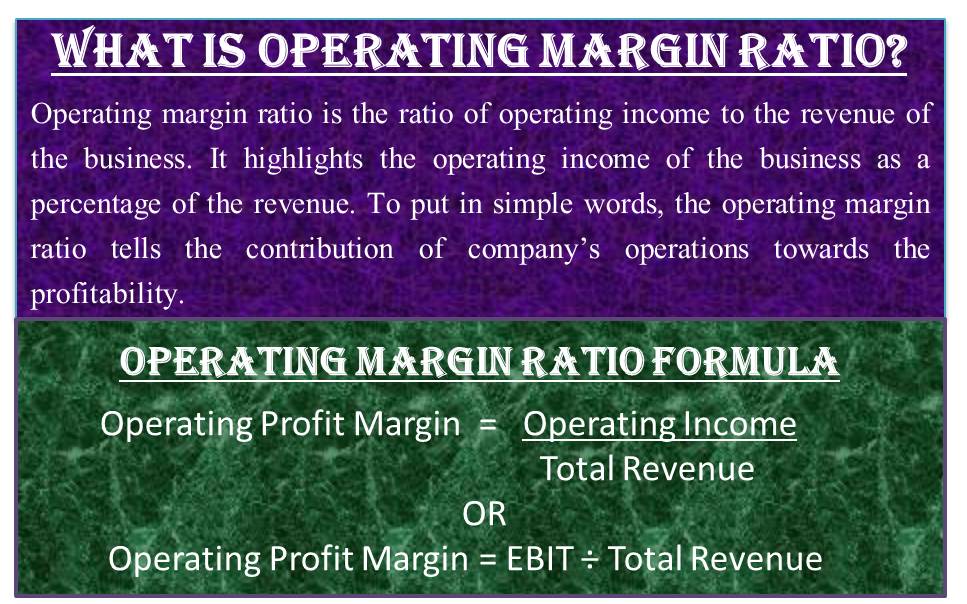

It is calculated by dividing a companys operating income by its net sales. It is an important indicator of efficiency and profitability.

How Do Operating Income And Revenue Differ

Operating margin operating earnings divided by revenue In this formula operating earnings are equal to a companys earnings before taxes and interest.

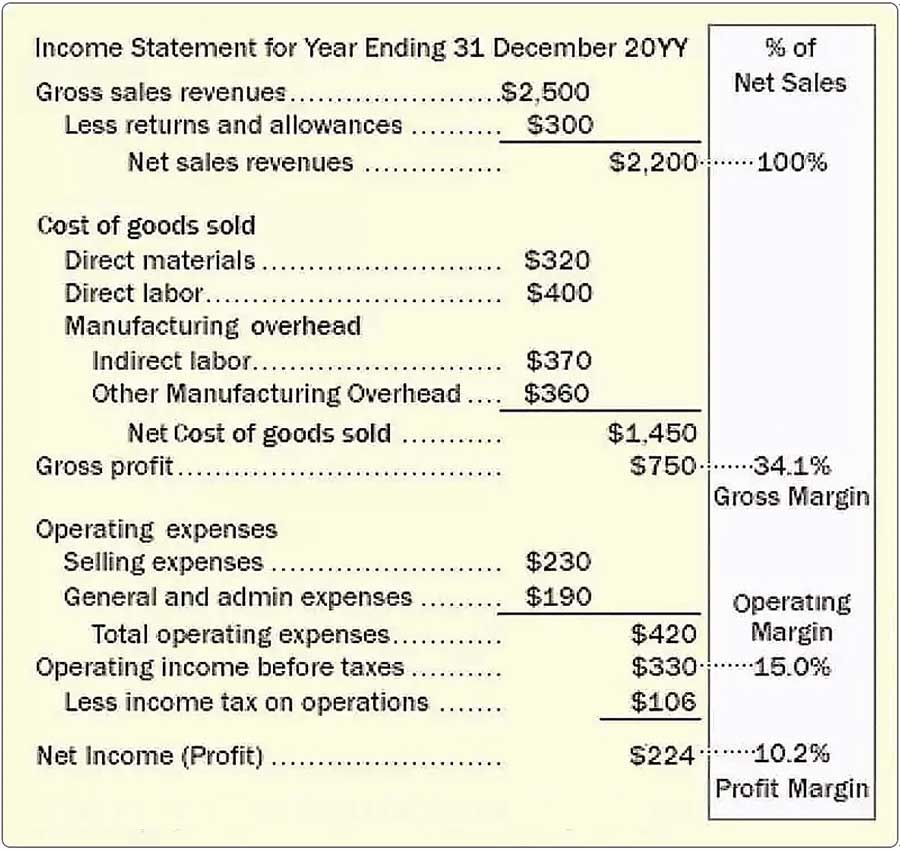

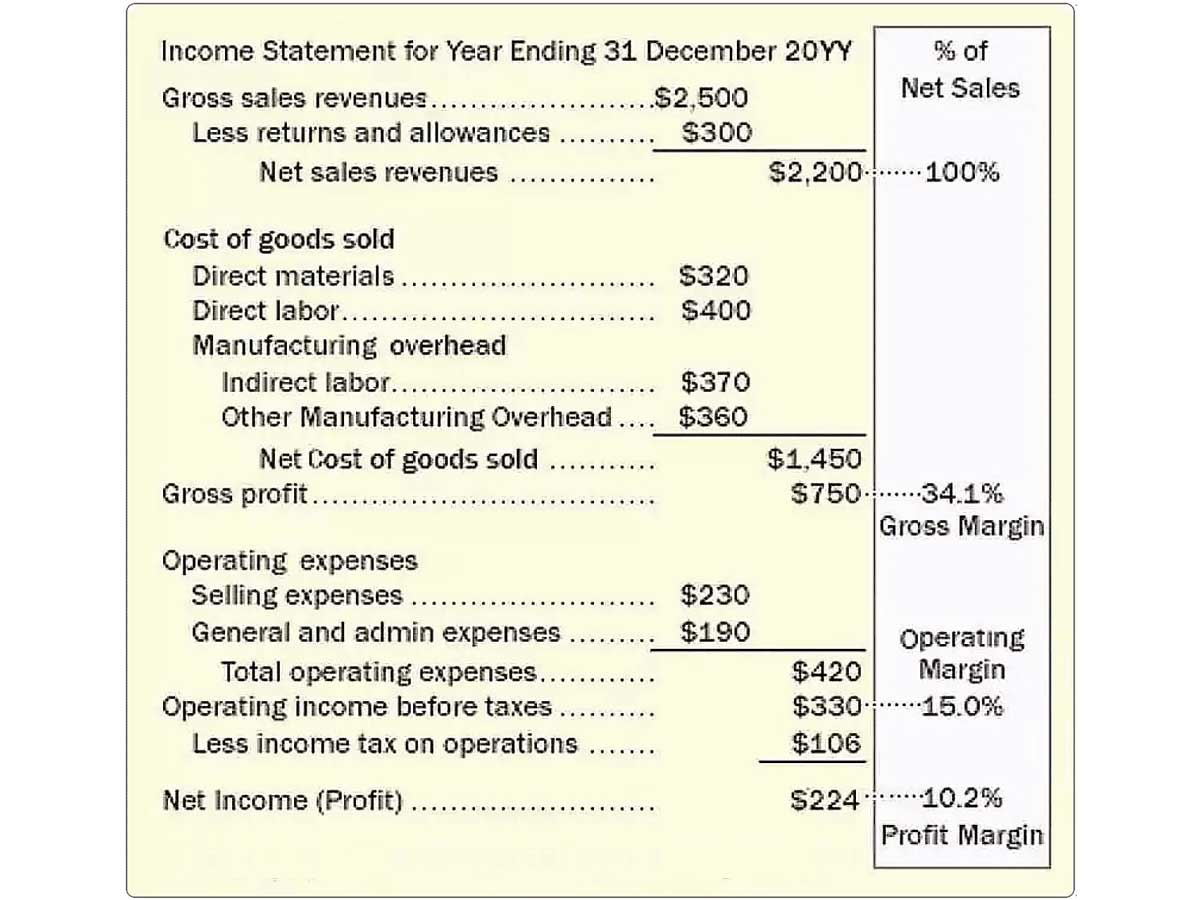

. Operating margin is calculated as operating income divided by revenue. Operating Margin Operating Profit Net Sales Company A 200 2200 9 Company B 800 3000 27 What this means is that Company A makes only 9 Operating Profit on. Like other profitability ratios Gross Profit Margin Pre-tax Profit Margin and Net.

Operating margin can be considered total revenue from product sales less all costs before adjustment for taxes dividends to shareholders and interest on debt. Profit margin Operating income Net operating margin Profit margin Indicator of profitability. Operating margin is also commonly known as Return on Sales ROS as it indicates the money left with a firm after deducting the operating expenses.

What Is Operating Margin. Operating Profit Margin is one of the measures to calculate the profitability of a company. Operating margins can be.

In business operating margin also known as operating income margin operating profit margin EBIT margin and return on sales ROS is the ratio of operating income operating profit in. Related to Operating margin. The operating margin measures how much profit a company makes on a dollar of sales after paying for variable costs of production such as wages and raw materials but before paying interest or tax.

Operating margin measures the proportion of revenue left over after paying the variable costs of production. Operating Margin means the incremental adjustments measured in megawatts required in PJM Region operations in order to accommodate on a first contingency basis an operating. Operating margin is widely considered to be one of the most important accounting measurements of operational efficiency.

Higher ratios are generally better illustrating th See more. It measures an organizations operating income. Operating margin additionally subtracts all overhead and operational expenses from revenues indicating the amount of profit the company has left.

This is similar to operating cash flow margin except it uses operating income. Operating margin is a profitability ratio that measures operating income relative to revenue. Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and.

Gross profit margin is a type of profit margin that measures the difference between sales revenue and the costs of goods sold COGS which includes direct product. Its a type of profit margin used to evaluate the performance of executive. The expert market analysts.

The ratio of earnings available to stockholders to net sales.

/ScreenShot2021-05-28at7.09.49PM-f53a583c48954953a7cd0d23454be040.png)

The Profitability Ratio And Company Evaluation

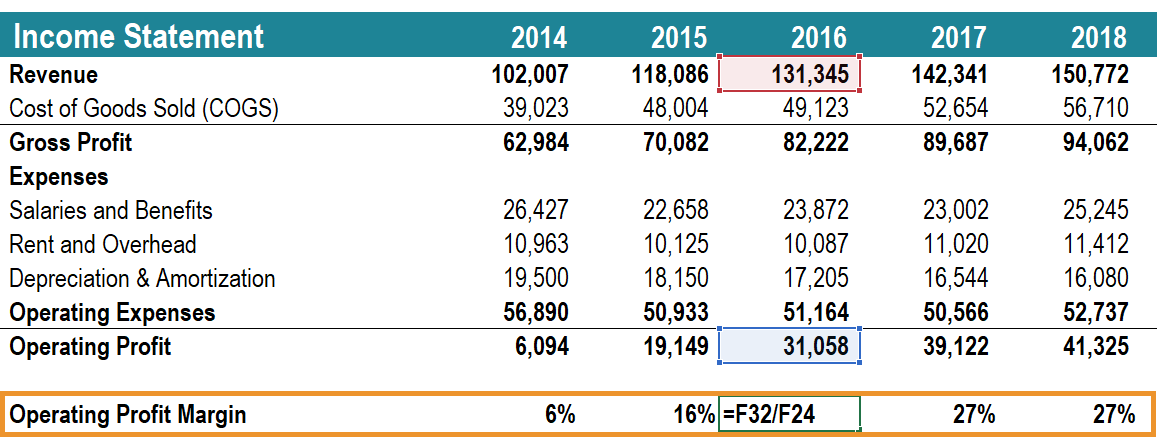

Operating Margin Formula And Calculator Excel Template

Operating Income Example Definition Meaning Veristrat Llc

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Margins Measure Business Profitability And Reveal Leverage

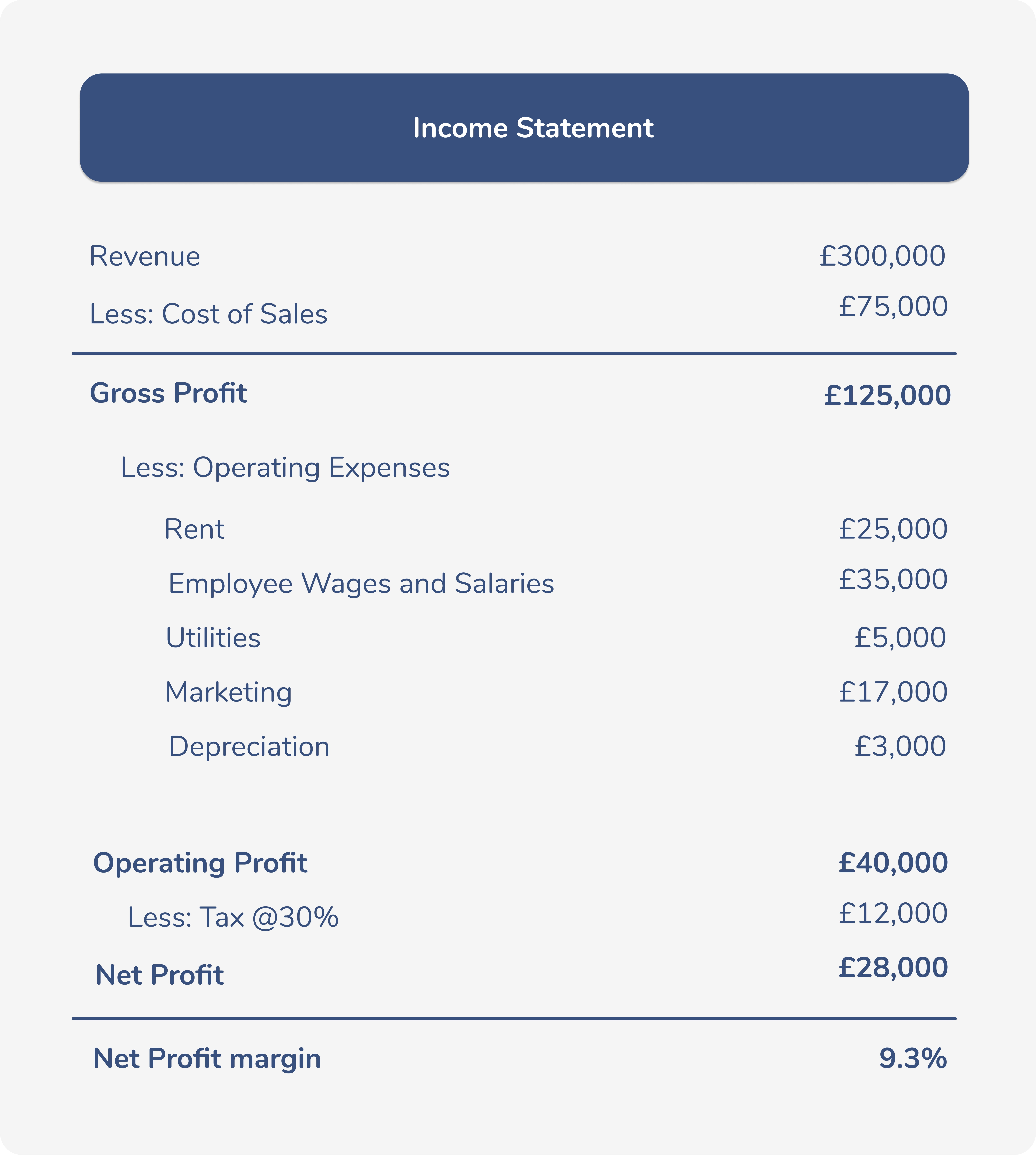

Operating Profit Margin Formula Meaning Example And Interpretation

Margins Measure Business Profitability And Reveal Leverage

Operating Margin Formula And Calculator Excel Template

What Is Operating Margin Ratio Significance Importance Example

Operating Profit Margin Formula Meaning Example And Interpretation

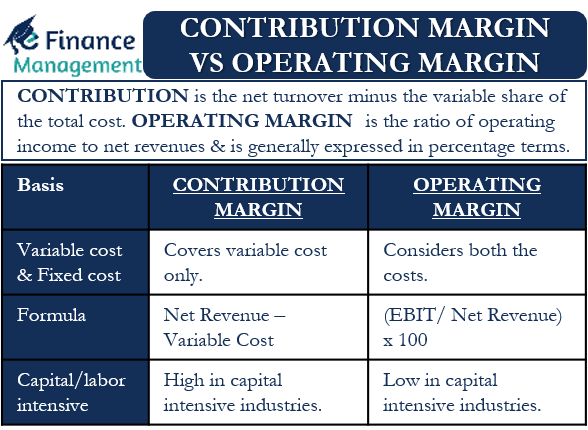

Contribution Margin And Operating Margin Meaning Differences Merits

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is The Gross Profit Margin Bdc Ca

Operating Profit Margin Learn To Calculate Operating Profit Margin

Operating Profit Margin Formula Meaning Example And Interpretation

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Operating Profit Margin Definition Formula And Calculation Wise Formerly Transferwise